The best money management apps

By Anum Yoon (follow her on Twitter: @anumyoon)

We all want to be masters of budgeting. With the technology we have now, budgeting can be a lot easier because we can use those computers we carry around in our pockets every day. These apps can help your budgeting issues become a lot easier.

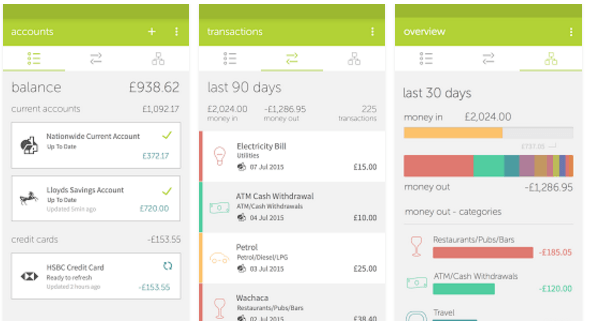

#1 OnTrees Personal Finance

OnTrees is one of the most popular UK finance apps — and for good reason. The app has all sorts of features that help you integrate all of your finances. You can connect all of your accounts and keep track of all your transactions. It splits all of your spending into separate categories so you can see where you’re spending all of your money and adjust it accordingly.

Available for Android and iOS

On Trees App

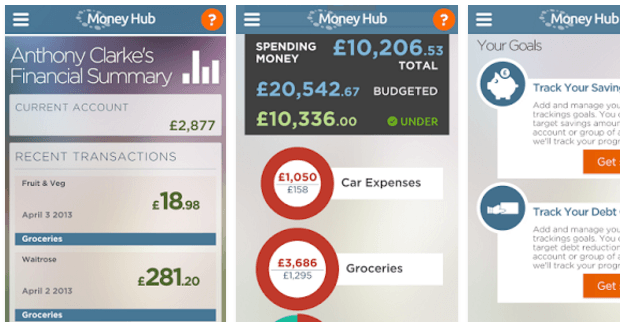

#2 MoneyHub

In addition to integrating your finances and letting you see where your money is going, MoneyHub helps you utilize that information to set some financial goals and track your progress as you try and meet them. This app is also helpful for long-term financial goals, as it offers calculators for items like taxes, pensions, house prices and more.

Available for Android and iOS

MoneyHub

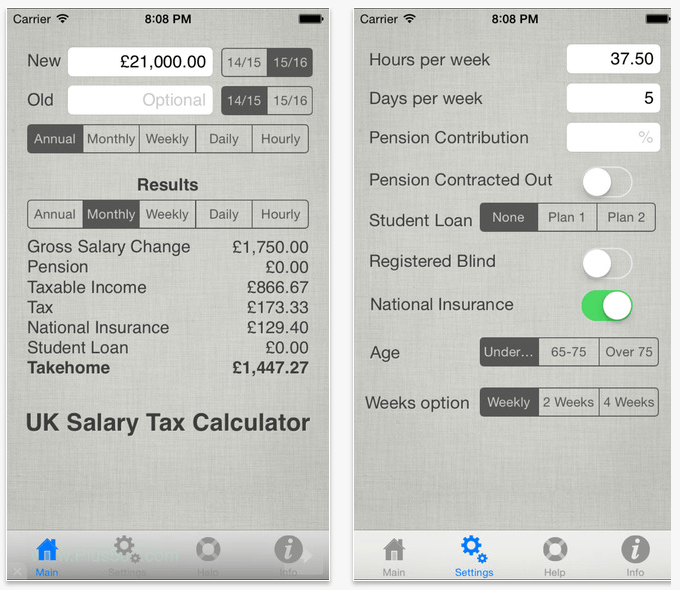

#3 UK Salary Calculator

When you’re looking for a new job, you’ll want to compare salaries of the jobs that are out there. Don’t do all those calculations yourself: This app does them for you. It lets you see the accurate take-home you’ll be making by letting you factor in things like student loans, taxes and National Insurance payments. This gives you the opportunity to plan a budget for things like groceries with the money you’ll be taking home each paycheck.

Available for iOS

UK Salary Calculator

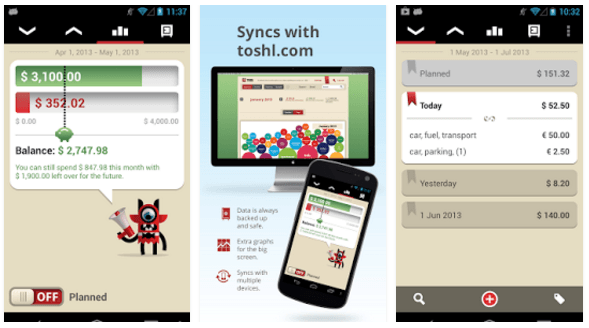

#4 Toshl Finance Budget & Expense

Toshl’s appearance makes it an appealing app to use — and it has the additional perk of using little Toshl monsters to spice up the way you get info about your finances. These monsters give you feedback on how your money is being spent by comparing your spending with that of other people like you.

You can also compare your spending to that of people in other countries and demographics. The app looks at your past spending and earning trends to help you plan for the future and you can activate push notifications to remind you to add your spending.

Available for Android, iOS, Windows Phone

Toshl app

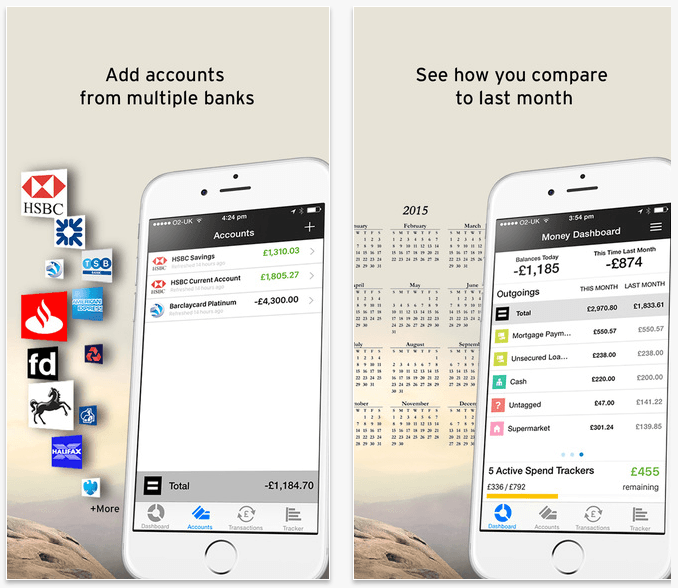

#5 Money Dashboard

Money Dashboard tracks the spending and earning on all of your credit cards and accounts and offers personal recommendations to help you improve your current financial situation. It tracks your past spending to help predict future patterns and it lets you set individual budgets to help you get where you want to be financially.

Available for Android and iOS

Money Dashboard

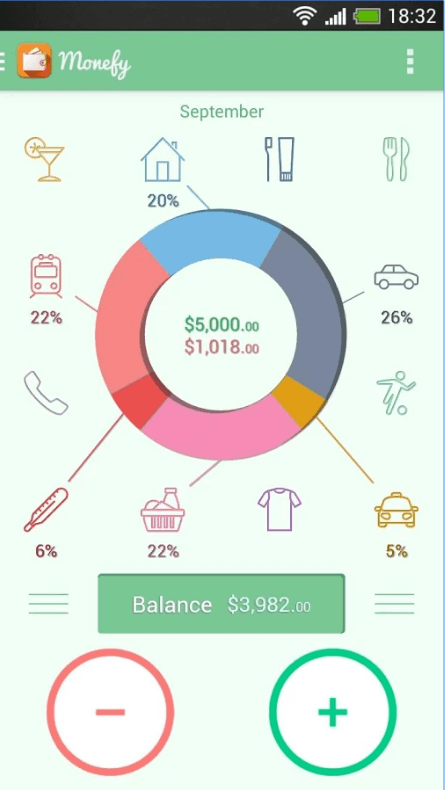

#6 Monefy

Monefy is another aesthetically appealing app to use. If you’re drawn to attractive interfaces, this would be more engaging for you than the other more “rigid-looking” budgeting apps. Monefy allows you to add cute icons for all the different items in your budget, and the best part is that you can customize each of them. For example, there are icons for coffee, magazines, and groceries. Plus, each item is automatically colour-coded, so you can see an immediate overview of your spending habits.

Available for Android

Monefy app

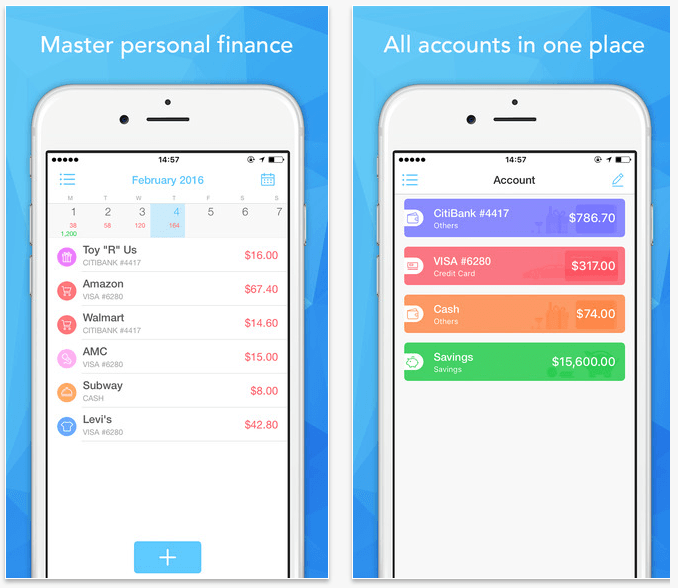

#7 Pocket Expense

Pocket Expense is an American app, but the good news is that you can change the settings to show pounds instead of dollars. There are a few other “American” things about the app – for example, I had to log my spending on “gas” instead of “petrol.” But enough about cultural differences. The app has fun bar charts that show you your spending patterns, but be warned that the navigation could be quite tricky at times.

Available for iOS

Pocket Expense

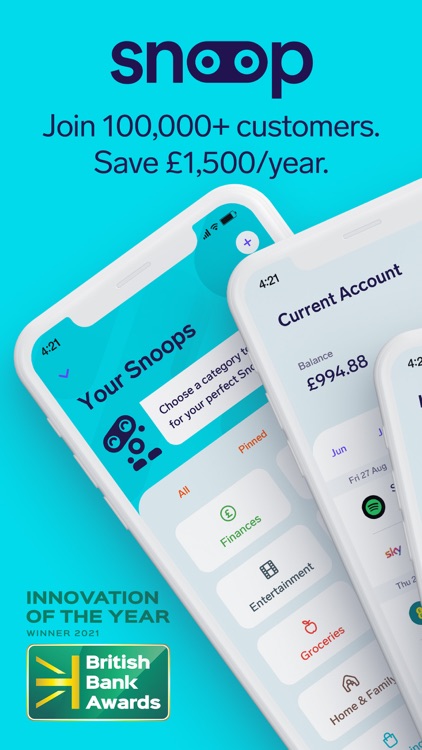

# 8 Snoop

Snoop offers a way to help users cut costs by managing their budgets, setting limits, and saving everywhere possible. It gives users access to extensive features after connecting the bank account that can find discounts, but also check for unexpected credit card charges, cheaper insurances and more. Snoop is continuously adding additional features to allow its users to save more!

Snoop

Apps Aren’t the Only Way Your Smartphone Can Help

Apps are great, but there are other ways your smartphone can help you budget. Download some free finance podcasts to listen to on your daily commute. These can keep you up to date on all of the latest budgeting tips and will offer you something to think about on your trip to work. When you’re home, you can always give the podcasts another listen and take notes so you can implement the tips they mention.

You don’t have to dread budgeting. With the availability of easy-to-use personal finance technology, keeping your finances in check is a whole lot more enjoyable. Try multiple ones to find a method that works for you!

About Anum

Anum Yoon is currently in London for her postgraduate studies. She spends all her free time looking for cheap and delicious eats. She runs a money blog for international students called Current on Currency.