The smart way to transfer money abroad!

By Kelly Henderson (follow Kelly on Twitter @kellythekiwi)

All over the world, people are transferring money from country to country and from one currency to another. Personally, I have transferred money home to New Zealand as a gift, to pay bills and just to top up my account over there.

What I didn’t know was that the banks were taking up to 5% of the money that was being sent. Wise (formerly TransferWise) is an alternative way of sending money overseas and a great way to avoid paying the hidden bank fees.

What is Wise?

Wise was founded by two London-based Estonians who were shocked by the high fees banks were charging to transfer money overseas. They realised that if they could bypass the banks and use the real exchange rate, they would save themselves (and others in the same situation) a lot of money. You can read the detailed story on MoneyTransferComparison’s thorough Wise review.

The technology behind Wise was developed by the creators of Skype and PayPal. They have managed to remove all the fees that were previously kept hidden by the foreign exchange industry.

Wise is a fair and transparent way of transferring money overseas. It costs up to 10 times less than the banks charge and the process is really easy.

How do I send money abroad using Wise?

Once you have signed up for a Wise account, sending and money is really simple. There are the steps:

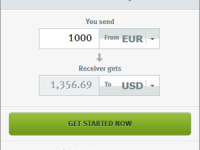

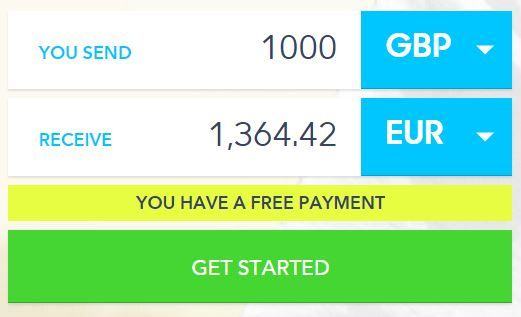

#1 Choose how much money you want to send and where you want to send it to.

This can either be into your own account (if you have one abroad) or one belonging to another person or business.

#2 Pay Wise the money that you are sending in your local currency.

This can be done in one of three ways:

- Bank transfer (online banking is the easiest way to do this)

- 3D Secure debit card (under £2000)

- SOFORT (if you have an account in Austria, Belgium, Germany, Italy, the Netherlands or Switzerland)

#3 Wise converts your money.

Wise will then convert your money based on the real exchange rate and match you with people sending money in the opposite direction. Your money will then sent to your nominated bank account.

TIP: If you sign up through the above link you will get a first transfer (up to 3k) for free (valid until 31/12/2014)!

What if I want to receive money via Wise?

You can start receiving money via Wise within minutes – and it’s a really simple process.

#1 Create your paylink. This is a request that will be sent to the payer telling them how much you want to be paid.

#2 Choose which bank account you want to be paid into.

#3 Share the link with the payer. They will then be able to pay the amount via debit card or bank transfer.

How much does Wise cost?

Wise always uses the real mid-market exchange rate. In other words, the rate of conversion that you would find on Google. There is no hidden commission added, and the service fee is tiny.

Wise charges a set fee for amounts under a certain threshold. For example, if you are transferring up to £200 into Euros then you would only pay £1. For amounts over the threshold, the service fee would be 0.5% of the amount sent.

There are a couple of exceptions to this – if you are transferring from USD, the way the service fee is calculated is slightly different so please have a look on the website for more information. Also, any transfers that involve SWIFT international payment are a bit more expensive so have a look to see how these fees are calculated.

I know that next time I am sending money home, I will use Wise – it definitely beats paying the bank.

—

You may also want to check out the best ways to save money on household bills.