Tips for getting the best deal when you wire money overseas

By Kelly Henderson (follow Kelly on Twitter @kellythekiwi)

There are all sorts of reasons why you may want to send money overseas – you might have savings in your home country that you want to bring to the UK, you may be helping out a friend or family member, or you may have bills to pay (like credit cards or bills on a second home) in another country. You may have some questions about the best ways to send money abroad – hopefully I will be able to answer them for you.

#1 What do I need to consider before I send money abroad?

Send British pounds

Before you make an international wire transfer there are a number of points that you need to consider. The Money Advice Service suggests you think about the following things:

1. How much money you will be sending – Foreign Exchange (FX) brokers will generally offer a better deal than the banks for large amounts of money.

2. How often you will be sending money (one off payment or regular payments) – Your bank may have a branch overseas or a special arrangement with an overseas bank. This makes them safe and convenient if you need to make smaller, regular payments for things like bills in your home country. Some FX brokers will also offer good deals if you are making regular payments.

3. How quickly you want the money to get there – Transferring money via the bank is normally the slowest option compared to using an FX broker or an online or high street money transfer service.

4. How the person wants to receive the money – Are you sending ‘instant cash’ or is the money going to be deposited into a bank account. You will need to know the IBAN (International Bank Account Number) and BIC (Bank Identifier Code) if you are depositing into another account.

5. How much it is going to cost to send the money – This will depend on the amount the company/bank charges for transferring the money, any charges for receiving the money (to be paid by you or the person who is receiving it) and the currency exchange rate. Keep reading to find the fastest and cheapest ways to send money abroad.

#2 What are the best companies for sending money overseas?

I have taken a closer look at five of the most well-known money transfer companies.

1. Wise

Wise (formally Transferwise) have bank accounts all over the world. When you want to send money overseas you pay into the Wise account in your country. They will then pay the recipient from the bank account in their country. This means that instead of paying huge hidden fees for converting currency, your money is being transferred at the real exchange rate. Wise does not hide its fees like some currency exchange providers do; it is deducted before conversion so you can see exactly how much money the recipient will get.

I’ve written about Wise in the past so if you would like some more information then have a read of this post.

2. HiFX / XE

Pic: contactdir.uk

HiFX or XE proudly claim that they offer ‘bank beating international money transfers’ by charging lower fees and giving you better exchange rates. Every month HiFX use an independent company to check that their overall price (including exchange rates, bank charges and other fees) is better than high-street banks and building societies. Their fees are simple – £9 if you are transferring less than £3000 and free if you are transferring more £3000.

Take a look at this post for more information about HiFX.

3. Halo Financial

Pic: www.linkedin.com

Halo Financial really personalise the money transfer process by assigning you with your own personal FX Consultant. They will help you get the best exchange rate, choose the right payment option and let you know when the exchange rate is best for you (or worse for you). There are just five simple steps to transferring your money with Halo:

- Open an account. Sign up online, over the phone or by post – it is completely free and you will not be forced to make a trade just because you have an account.

- Get a quote. Your personal FX Consultant will find out what your needs are and discuss the best options for you. If you want to go ahead they will quote you an exchange rate over the phone and you can either accept or reject this offer.

- Confirm your trade. You will receive a confirmation email letting you know what the next steps are. You will need to let Halo know all the recipients details and they will tell you how to make the payment.

- Send your funds. You need to transfer the funds that you are sending into a Halo account. This can be done by electronically or by sending a cheque. Once Halo has received your funds they will notify by email.

- Halo sends your payment. Once Halo has received your funds and the recipient’s details then they will transfer your money. You will be notified once the payment has been made.

4. CurrencyFair

Pic: fx-rate.net

CurrencyFair is a peer-to-peer marketplace – you exchange with people who are going in the opposite direction to you (want the currency that you are trying to sell). CurrencyFair match you up so that you can get the best possible exchange rate. Like TransferWise, the bank accounts are local so the transfers are quick and you don’t have to pay high conversion fees.

Depending on your needs, there are two options available to you:

- Quick trade – for people who need to exchange money quickly, you will be offered the best available exchange rate.

- For people who want a better rate – post your funds onto the marketplace with your preferred rate and wait for a match.

Right now, Broke in London readers will get £15 credit in their CurrencyFair account and a free transfer by clicking on this link.

5. Moneycorp

Pic: moneycorp.com

I used Moneycorp to send money from the UK to New Zealand and definitely recommend this service. The rate was one of the best that I saw, the payments went through promptly and I was lucky enough to have my first five transaction fees waived.

Moneycorp work a bit like Halo in that you are assigned a personal account manager to help you with sending your money overseas. You also need to pay your funds into a Moneycorp account before they make the transfer. This can work in your favour as you are able to set a target rate and be alerted by email or SMS when the currency reaches that rate. As the money is already in a Moneycorp account, the transfer can be made straight away allowing you to take advantage of your chosen exchange rate.

Until July 31st you will pay zero transfer fees if you send money overseas using Moneycorp.

#3 How do I decide the best way for me to transfer money overseas?

If you are still unsure about the best way to send money overseas then keep reading…

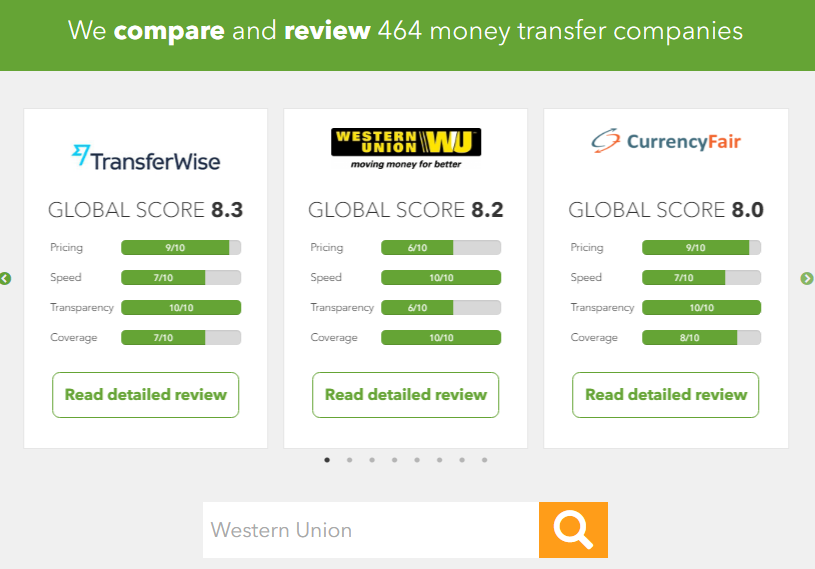

Monito comparing widget

In the past banks have dominated the money transfer market… this is definitely not the case anymore. There are a huge number of money transfer companies, both online and on the high street. Unfortunately, having so much choice can lead to confusion and a feeling of being overwhelmed. This is where Monito (ex Tawipay) steps in. This website is an excellent resource to use if you are planning to transfer money overseas. It compares 469* money transfer operators and banks across 217 countries.

*this number is constantly increasing!

The comparison tool is really easy to use and free to sign up to. Plus, here are 5 more advantages of using Monito before you send money overseas:

1. Less money being wasted in excessive fees

Did you know that on average a recipient will only receive $92 for every $100 sent? Monito take all fees (transfer fees, currency exchange fees, credit card fees, etc) into account when they make their comparisons.

2. You get a full breakdown of the fees you (and the recipient) are paying

There are sometimes hidden fees involved in transferring money. For example, some companies will charge the recipient a fee when they claim the money… you might not know this until they tell you (and they may not be very happy!). Monito give you a full breakdown of the fees each company charges so you know

3. Find out about special deals/offers

From time to time, different money transfer companies will offer special deals. These may include zero transfer fees on the first transfer of credit (in the form of pounds) for Monito users.

4. You will find out what really is the best option for you

Because everybody’s needs are different and change all the time, the best money transfer option for you will change as your needs do. Monito will compare operators depending on transfer times, pay-in/pay-out options and the amount of money you are sending.

5. You could save a lot of money!

This is probably the most important reason to use Monito before you send money overseas. Your favourite money transfer company may not always have the best deal and it’s impossible for you to look all of the companies up. Monito saves you time by having all of the companies in one place and potentially will save you money by showing you the fees charged by all of them.

Once you decide to compare money exchange companies using Monito (and you should) then it is really simple to start transferring money. All you need to do is fill out the online form, choose the best operator from the list and make the transfer.

#4 How to wire money overseas for free?

If you would rather not pay any fees there are also a few ways that you can wire your money for free.

1. Xendpay

Pic: xendpay.com

If you’re not going to be sending more than £2000 per year then you can do it for free by using Xendpay. You are invited to pay what you want in terms of transfer fees but this is not compulsory – and you won’t see the lack of charges hidden in the exchange rate either. Of course, they would like some money to cover costs but you get to choose how much (or how little) you pay them. Because there are no fees, Xendpay is great if you only need to transfer a small amount of money – you can send as little as £1/€1/$1.

For example, if you need to send pounds to your Indian account, it makes sense to check conversion rates from Eur to INR.

2. Free Bank Transfers

If you’re looking to send money using your bank account, there are some banks who will allow you to transfer money to overseas branches for free.

HSBC offer free transfers around the world to another HSBC account. It doesn’t matter if it is your bank account or not – as long as the transaction is completed through their online banking system. It does pay to check the exchange rates though as generally these aren’t the best and it might be worth paying a fee to another money transfer company.

Other banks (State Bank of India, Lloyds Bank and Danske International for example) off fee-free money transfers to their partner banks in other countries. These banks differ from HSBC though as the second bank account must also be in your name.

3. Let money transfer companies know you are doing your research

As I mentioned, when I used Moneycorp they waived my first 5 transfer fees… and now I am recommending them to you! This is what companies want. If you let them know you are shopping around then they may give you a better deal to get you to send your money through them. They know if you are happy with the service you will use them again and tell your friends about it.

#5 I’m a bit confused by some of the language here…

Some of the words and terms used by banks and money exchange companies seem like an entirely different language to me… and I only speak English! Luckily, the nice people at XE.com have put together a glossary of Commonly Used Money Transfer Terms. I’m not saying you need to memorise this list (it is pretty long) but if you get stuck, this is a great reference.

Whether you are moving countries, paying for a wedding at home or helping out family and friends then it is important to get the best deal when you send money overseas. Remember to think about how much you are sending and what the money is for, do your research and choose the money transfer company that is best for you – it is different for everyone!