How to Save Money on Bills

Bills can be one of the biggest pains in life. For those who don’t have much money to spare while living in London, even if you’ve already gone and found that cheap house to live in, or at least somewhere to stay the night- bills are the biggest drain on what little money you have left, and are a source of huge worry for most people in the world. Fortunately, we’re here to help! We’ve had a look at a number of different sources, and have found ways to trim those bills and add a little extra money to your pocket every month.

#General Tip

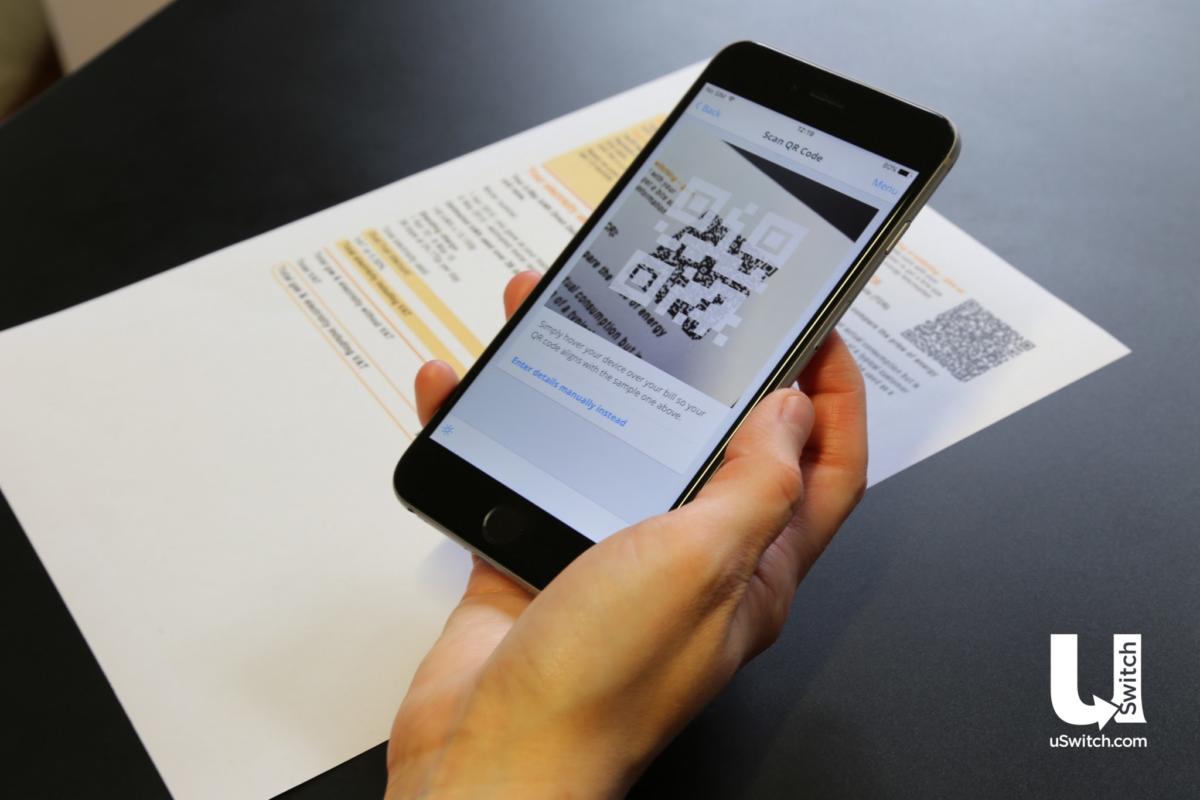

There is one single website that can instantly save you a heck of a lot of money and it’s called uSwitch. uSwitch is a price comparison website of gas and electricity suppliers, digital TV providers, home telephone providers, internet broadband, and mobile phone packages. The website compares all different plans on the market to find the best deal suited to you. Households can save up to £679 per year just by switching energy supplier! Nearly anyone can do it, it’s free and it only takes 10 minutes. Check out what we have written about uSwitch here.

#1 Electricity Bills

Common Knowledge Tips

Electricity can be one of the most expensive bills you’ll have to pay, especially for younger house-owners with lots of technology to upkeep. Some of the best tactics in this category can be some of the simplest- turning off plugs when you’re not using them and never leaving anything on standby can save around £50-£80 a year! Using items effectively, for instance never overfilling a kettle when you’re only making one or two cops of tea, can save hundreds more.

Cool it Off

There are some tips, however, which might take a little more than simple common knowledge to figure out. Turning down your thermostat by just one degree can save £75 a year, and you probably won’t even notice the difference. In a similar vein, programming your heating to go off when you’re out or asleep, and on only when you’re in the house, can save a ton as opposed to leaving it on 24/7. While we’re at it, the myth is wrong: leaving them on at a constant low level isn’t more efficient than turning them on or off.

You can cut out a lot of heating costs by sealing windows and doors with weatherproofing strips, or just by double-glazing your windows to trap all the heat in and keep the cold out. By warming your house up even a little, these tactics will allow you to turn down that thermostat and keep your radiators off- saving a lot in the meantime.

Finally- and admittedly, this is a circumstantial one- for those living near wooded areas or lots of trees, getting a wood burner can be a huge money-saver. Obviously, you’ll need a lot of wood to keep it running, and the smoke can get a bit annoying, but huge savings can be made by cutting out all your heating in one fell swoop.

Swap it Out

If you can’t reduce your electricity usage anymore and still want to keep saving, a good idea is to think of what you can replace. If you have any light bulbs that aren’t yet energy efficient, swapping them out for newer ‘green’ bulbs can save you a lot, both in electricity usage and lifetime length of the bulbs.

Switching up old utilities, such as your freezer or microwave, to newer and more energy-efficient versions, can be a great long-term investment. Top range freezers cost around £150-300, meaning you’d recoup your costs after about 8 years, and then keep on saving!

#2 Water Bills

Get a Water Meter

While there are fewer tips to help out lowering your water bill costs, there are some great ideas out there that you might not know which can shave off some extra pounds every year. The first and foremost of these is to get a water meter– most houses already have one, but if you don’t, you could be paying for far more than you actually use. Your bill provider is obliged to fit one for free, but if they absolutely can’t (some houses just can’t have them, don’t take it personally) then you can request an assessed bill instead.

Assessed Bills

An assessed bill is a water bill that adds up statistics to determine roughly how much you should be paying, based on the number of bedrooms in your property, the number of people living there, and the average water bill in that area. If you’re being drastically overcharged for water as it is, an assessed bill can definitely help to lower the costs. Even if it turns out more expensive than what you were paying before, you can always cancel it- so it doesn’t hurt to try!

Other Water Tips

Try and always take showers, never baths- and while you’re at it, replace that old shower head with a newer, water-efficient one, which can save around £72 each year. You can also save on gas or energy bills by doing this, so it’s a great way to cut costs easily.

Finally, make sure that you only run water when you absolutely need to- turn off taps when you’re brushing your teeth, and make sure there aren’t any leaks in your house- if you find one, fix it immediately, as they can cost you 5,500 litres of water a year!

#3 TV, Phone and Internet

TV Package Deals

For the most often-used household gadgets- TV, phone, and internet- there are a number of ways to save money that can allow you to keep watching those films without paying through the nose for the privilege. Getting several services from the same provider can cut a lot of costs- but only as long as you’re getting the most out of the stuff you’re paying for; select bundle packages are the best, letting you watch what you’d normally watch for less. For example, Sky TV is £19.50 a month: but their combined broadband and TV bundle is exactly the same price.

Free TV and Calls

With the majority of TV now online, either live streaming or as view-on-demand, there really isn’t even that much need for a television: all major UK channels have an online version, where you can catch up with all your favourite programs- as long as you don’t watch programs airing live, you don’t even need a licence! Taking your TV obsession online can save you over £100 a month, with absolutely no downside to you- so what are you waiting for?

When using your phone, make the most of any privileges your deal or phone provider give you: free evening or weekend calls! Use them as much as you can! The importance of Skype cannot be stressed enough- free to install, it allows you to call anyone in the world, without paying a penny. With most phones now able to download it as well, there’s no excuse not to use this whenever you possibly can.

Internet Dongles

Don’t use the internet that often? A lot of people don’t know that you don’t need to have a contract or monthly bill to have access to the internet. Internet dongles (yes, that actually is the technical term) are USB devices which can plug into your laptop and provide pay-as-you-go or monthly contract internet, even on the move. While they tend to have lower memory, meaning that your internet usage will have to be pretty light, and can be a little more expensive than fixed-line contracts if you pay regularly, for those who only use the internet lightly or irregularly will save a fair bit from these handy little devices.

#4 Council Tax

There are a couple of other important tips which can save money on household bills. It’s a good idea to check and see if you’re in the right council tax band– due to the slapdash nature in which they were implemented, many houses are still in the wrong tax band to those around them. If you’re one of these, you wouldn’t just see lower costs in the future, but also money back for all your overpayments in the past! While it’s a good idea to do some research and ask neighbours how much they’re paying, in the end, you’ll have to contact your Valuation Office Agency and provide some evidence of the discrepancy. If you’re right, you’ll save a lot of money- in some case thousands- and keep up with the Jones’ while you’re at it.

Council tax bills are based on the assumption that two people are living in the property- if you’re living alone, or with a full-time student, someone you care for, or a monk or nun(?!), then you’re eligible for a single person discount of 25% off– speak to your council to change details.

#5 Save Money on other Household Bills

Switch it Up!

While we’ve already covered most of your regular bills, there are a couple of other ways to save regularly and keep house costs low. Many experts recommend regularly switching your service providers, on average once a year- this can always get you the best deal, or make your company fight harder to keep you. Some companies, such as uSwitch, state that you can save up to £530 this way.

The stats back this up- in a countrywide study, it was shown that house-owners in Greater London were in the top three areas to overpay on energy bills, by up to £275– strongly linked with the fact that Londoners are half as likely to switch suppliers as a lot of the rest of the company. Remember- if you’re only renting a property, you’re still allowed to switch! Ask your landlord about it- as long as you’re both saving money, they shouldn’t complain too much.

Other Ways to Save

There are a number of other ways to save money every month, across your whole range of living: there are hundreds of tips for buying food at the supermarket, such as switching to value brands instead of premium, which can save you hundreds a year; giving up the car in favour of public transport or cycling can be a huge money-saver. Furthermore, if you’re suffering from a disability, you can save some money by qualifying for a free boiler upgrade. Finally, quitting that gym membership you don’t really use and instead finding a way to be healthy at home can free up a little extra money for enjoying yourself every now and then. After all this money-saving, you deserve it!

As you can see, there are hundreds of ways to save at home, on every one of your household bills: okay, so a lot of them save only a couple of quid a month- but imagine putting all that together. There’s real money all around your house, just waiting to be found- and with these tips, you can absolutely get it.

—

For more great tips on saving money, check out our Ten Best Ways to Save Money.